Yale University has named Matthew Mendelsohn as its next chief investment officer for the endowment fund that has embraced a form of asset allocation widely copied and discussed in sectors including family offices and wealth managers.

Mendelsohn succeeds David Swensen, who managed Yale’s endowment fund for more than 35 years, growing the fund from $1.3 billion to more than $31 billion during his tenure. Swensen died in May at 67 after a long battle with cancer.

His work at the fund established Yale as a global leader in endowment investment management. Income generated from the fund covers around one-third of the university’s annual budget. Only Harvard has a larger endowment among US Ivy League schools.

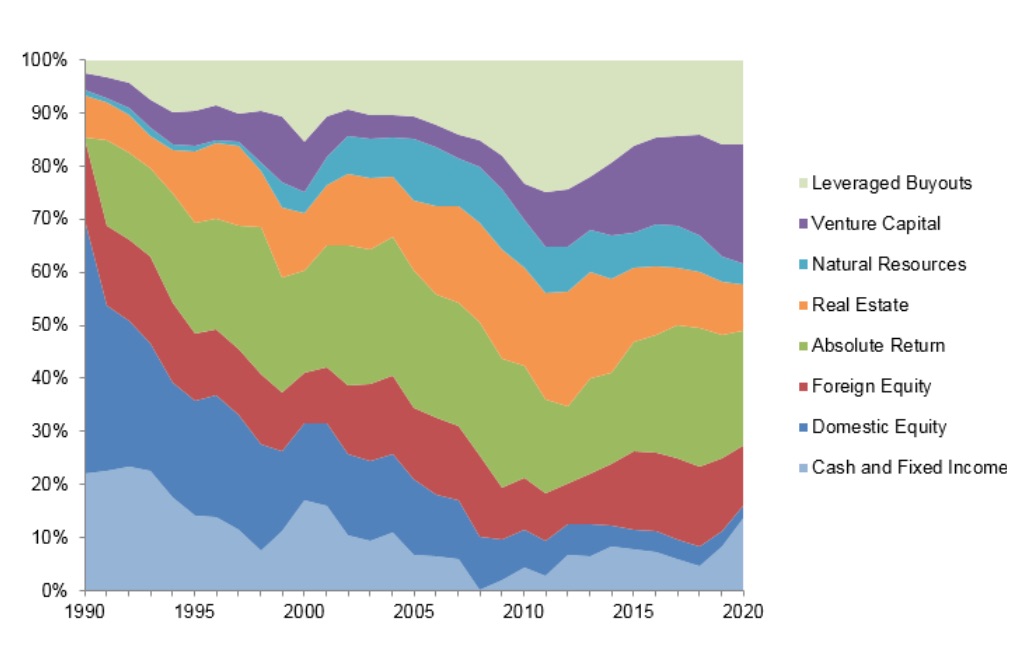

The "Yale Model" concentrates on holding alternative asset classes, such as venture capital, private equity leveraged buyouts, oil and gas, timber and real estate. Such relatively illiquid investments generate higher returns on a risk-adjusted basis over time when compared with listed equities. The philosophy behind the model is that most investors "overpay" for liquidity and unnecessarily sacrifice returns. Since the 1980s, the Yale endowment fund slashed exposures to conventional equities and debt.

As its website says of the fund: "The heavy allocation to non-traditional asset classes stems from their return potential and diversifying power. Today's actual and target portfolios have significantly higher expected returns and lower volatility than the 1985 portfolio. Alternative assets, by their very nature, tend to be less efficiently priced than traditional marketable securities, providing an opportunity to exploit market inefficiencies through active management. The Endowment's long time horizon is well suited to exploiting illiquid, less efficient markets such as venture capital, leveraged buyouts, oil and gas, timber, and real estate."

The new boss

A Yale graduate in physics, Mendelsohn joined Yale Investments Office in 2007, and has had a hand in managing most of the asset classes in which Yale invests. At 36, he currently oversees venture capital assets, which make up over a quarter of Yale’s total endowment. YaleNews reported that the VC portfolio has returned 21.6 per cent annually for the last 10 years, emphasizing the continuing importance private markets and unlisted assets will play in the future direction of the fund.

His appointment follows an extensive international search led by economics professor and former Yale provost Ben Polak.

Overall, the fund has returned an average of 12.4 per cent annually over the past 30 years; its performance has stoked admiration and replication of its “model portfolio approach." Swensen began managing the fund in the mid-80s at the age of 31, diverging radically from the standard stocks-and-bond portfolio favoring a 60:40 split. The chart below shows how the endowment has shifted allocation over the last 30 years. Domestic securities account for less than 10 per cent of the portfolio today, while foreign equity, private equity, absolute return strategies, and real assets account for over 90 per cent of the fund.

Although Swensen's approach has now become established practice, the industry has been keen to see who would be named as his successor.

“Matt shares David’s hallmark qualities: He’s analytically rigorous both in his disciplined approach to asset allocation and in his first-principles approach to specific investments; he has incredible insight into the character and dynamics of his team and of Yale’s outside managers; and he starts from the core belief that everyone involved with the Yale endowment must operate with complete honesty, integrity, and transparency,” Polak said in a statement yesterday.